The question as to where lead markets will develop for both electric and fuel cell vehicles (EV and FCV respectively) has been researched by the European Joint Research Centre (JRC) and their findings have been detailed in the report below. Several JRC studies concluded that privileged access to dedicated lanes, such as EV drivers in Norway who are able to make use of bus lanes, parking facilities, adapted city centres, commuting behaviour, the environmental footprint and fuel cost savings were all important factors. Each of these elements were analysed by the JRC at both regional and city level in order to help identify the most likely markets to develop for these two technologies.

In a business-as-usual scenario, in 2020 the experts envisage only a few insular lead markets for electric vehicles and a relatively limited number of more connected lead market regions in 2030. In a more optimistic scenario, there could be a wider distribution of electric vehicles in 2030 across most of Germany, the Netherlands, France, the UK, Ireland, and Italy. The cities of London, Madrid, Berlin, Paris, and Rome would show high electric vehicle sales under this scenario, with London as the standout amongst the rest according to the JRC data (refer to map below).

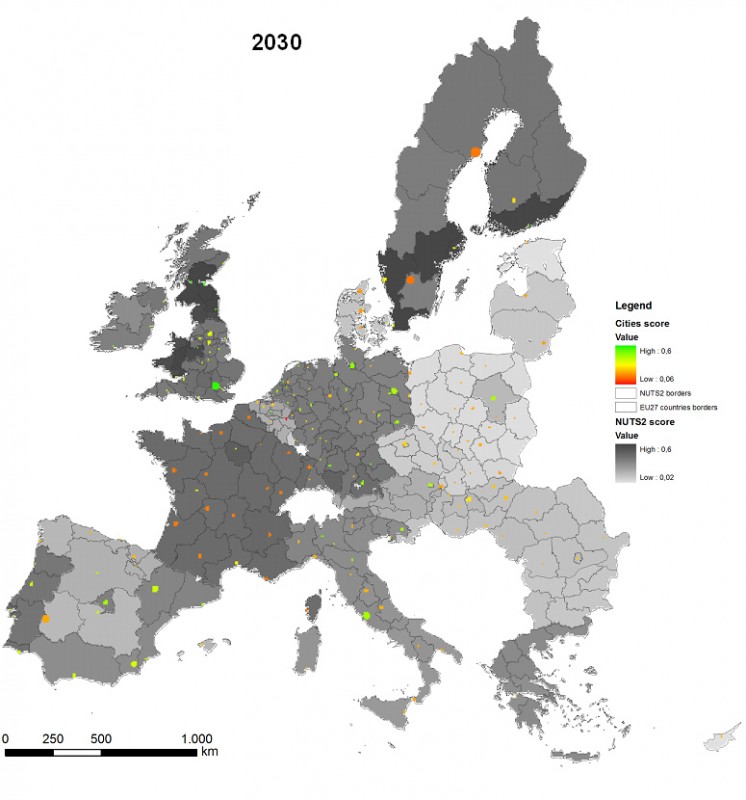

The JRC assessment indicates that in 2030 Sweden, Finland and Austria show, according to our analysis, one of the highest lead market scores for hydrogen fuel cell vehicles. According to the study the difference of the lead market potential between the EU15 and EU12 would be smaller in 2050.

With the help of a fleet impact model, the JRC also calculated that the deployment of hybrids, plug-in hybrid, battery electric, and fuel cell vehicles can – depending on the scenario – decrease CO2emissions in EU-27 passenger road transport by 35–57% and primary energy demand by 29–51 Mtoe (million tonnes of oil equivalent) in 2050 versus the baseline scenario. These improvements would be realised by the higher efficiency of advanced vehicles and by the fact that electrified cars could be fuelled by a decarbonised European electricity and hydrogen mix. The research also showed that, already in the 2020 to 2030 timeframe, technology learning effects can lead to acceptable payback periods for electric drive vehicles owners.

The results of these studies can help policy makers identify measures that could foster the development of electric and hydrogen lead market regions. This is especially crucial as a large scale deployment of hydrogen and electric vehicles goes together with the development of the related infrastructure needs. Lead markets will be the nuclei for further market replication and spread. Furthermore, the JRC’s work can be used to guide cohesion policies aiming at a sustained and widespread deployment of these environmentally friendly vehicles across the EU.

Source; Joint Research Centre, European Commission